NRIs' mutual fund holdings rise 27% in St rally

NRIs' mutual fund holdings rise 27% in St rally - Units issued to NRIs accounted for 99.8% of the total amount on surging valuations.

Spurred by meaty valuation rise, foreign liabilities of mutual fund (MF) companies galloped to $11.11 billion (Rs 71,980.7 crore) in financial year 2017 (FY17), showed Reserve Bank of India (RBI) survey on Tuesday.

Of the total liabilities, units issued to non-resident Indians (NRIs) accounted for 99.8%. Foreign assets stood at $597 million (Rs 3,870 crore), a very small portion of their foreign liabilities that indicates that they held most of their assets within the country. In FY16, foreign liabilities stood at $8.76 billion (Rs 58,167.8 crore) while foreign assets then were at $574 million Rs 3,804.8 crore.

Talking about the foreign liabilities, RBI said, "Large valuation changes caused a surge in foreign liabilities of MFs during 2016-17, with the rise in the market value of units (23.6% in rupee terms) far exceeding the growth in their face value (4.0%). As a result, the ratio of market value to face value of liabilities increased to 2.66 in March 2017 from 2.24 a year ago, indicating valuation gains during 2016-17."

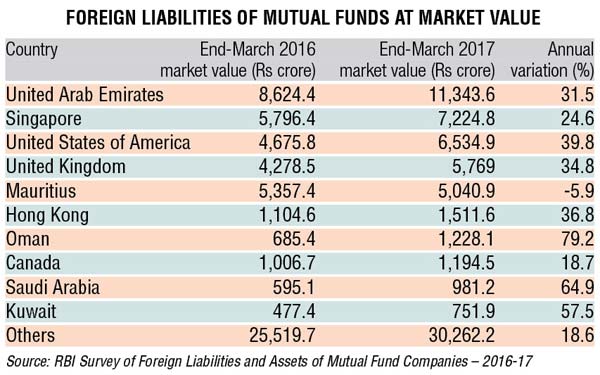

NRI investment from a few countries account for a substantial chunk of foreign liabilities of MF companies. UAE (Rs 11,343.6 crore), Singapore (Rs 72,24.8 crore), UK (Rs 5,769 crore), USA (Rs 6,534.9 crore) and Mauritius (Rs 5,040.9 crore) together accounted for half of the MF units held at market value by non-residents in March 2017, said the survey covering 44 Indian MF companies.

Interestingly, units held in Mauritius recorded a sharp decline, coinciding with the signing of the Protocol to amend the India-Mauritius Double Taxation Avoidance Agreement (DTAA) during 2016-17. "Many financial structures relied on the DTAA between India and Mauritius for relief from certain Indian taxes. The DTAA has recently been renegotiated, which virtually shuts the door on investors using Mauritius to avoid paying taxes in India," said the CEO of a mutual fund company, requesting anonymity.

As far as equity securities held abroad by mutual fund companies are concerned, USA (44.5%) and Luxembourg (43.1%) remained the major overseas investment destinations for MF companies, shows the RBI data. Foreign securities are bought by MFs for global international equity funds. Many Indian investors like to use the global equity fund route to take exposure to foreign assets. "There are a few Indian funds which nowadays take active positions in US equities like Alphabet, Facebook, and Google. High networth investors (HNIs) want to take cost effective and tax efficient routes to get a US play," says Sandeep Varma, a financial consultant who deals with HNI clients.

Asset Management Companies (AMCs) associated with MFs had net foreign liabilities of Rs 524 crore ($0.8 billion) in March 2017 (liabilities of Rs 5,680 crore minus assets of Rs 440 crore), according to RBI survey results.

"Foreign liabilities of AMCs were largely owed to NRIs in Mauritius, UK and Japan whereas Guernsey was the main destination of their relatively small overseas assets," said the financial regulator.

The reinvested earnings of foreign direct investors in the AMCs (estimated from their share in the difference between a company's net profit and distributed dividends) stood at Rs 530 crore in 2016-17 --- almost unchanged from Rs 540 crore in the previous year.

Stay on top of NRI news with the WelcomeNRI.

India Business Report

Reserve Bank of India

Mutual Fund

NRIs

foreign assets

Double Taxation Avoidance Agreement

DTAA

Asset Management Companies

non-resident Indians

Foreign liabilities

nri invest mutual fund

invest in Indian mutual funds

NRIs investing in India

Mutual fund guide for NRIs

NRI money

NRI Investment

NRI

mutual funds

Mutual Fund investment

markets

NRO

print media sector

real estate business

nri invest india