When we think about investing in precious metals, how often do we look beyond gold and silver? Not very, one would say. Platinum, say experts, can be a good portfolio diversifier.

MONEY TODAY speaks to market experts to understand the investment opportunities in platinum.

In India, the metal trades on the National Spot Exchange, owned by the Financial Technologies group. Platinum is primarily an industrial metal. The automobile sector is the biggest consumer (55 per cent), followed by petrochemical (25 per cent), jewellery (15 per cent) and electronic and dental (5 per cent).

FROM THE MAGAZINE: Diamonds can sparkle as an investment option

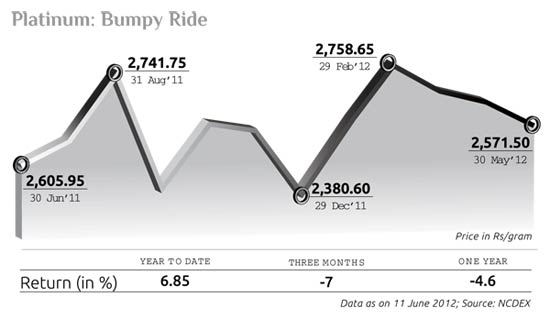

Since the beginning of the year till 11 June 2012, platinum prices underperformed that of gold and silver. However, due to supply fears in South Africa, a major producer, the metal gave 7 per cent return on a year-to-date basis till 11 June 2012, according to data on the National Commodity and Derivatives Exchange.

That day, e-platinum was trading at Rs 2,816 per gram on the National Spot Exchange. Between 2 January 2012 and 11 June 2012, gold rose 9 per cent to Rs 29,582 per 10 gram while silver was up 8.9 per cent to Rs 54,520 per kg on the MCX.

Hitesh Jain, analyst, commodity, metals and currency, IIFL, says, "Supply risk in South Africa has protected platinum. The six-week strike by workers at Impala Platinum Holdings' Rustenberg mine in South Africa resulted in 120,000 ounces (3.73 tonnes) of lost output." The strike ended on 5 March.

South Africa produces more than 60 per cent of the world's refined output while significant amounts are recovered in Russia and Canada as a by-product of nickel mining.

GFMS has forecast that global supply will reach 250 tonnes in 2012 and there will be a surplus of 195,000 ounces (six tonnes). GFMS, formerly known as Gold Fields Mineral Services, is a leading independent precious metals consultancy specialising in gold, silver, platinum and palladium. GFMS estimates that in 2011, the global market had a surplus of 735,000 ounces (22.85 tonnes).

FROM THE MAGAZINE: Smart ways to get rich

Experts are bearish on the metal. "Most of the demand comes from the automotive industry. Chinese car sales are stagnating and European automobile demand is showing signs of slowing. Contagious manufacturing slowdown across the globe and record fuel prices do not spell good tidings for the automobile industry," says Jain.

Vivek Gupta, head of research, CapitalVia Research Global, says, "Investors should stay cautious for the next two-three months. If platinum takes support from Rs 2,350 per gram to Rs 2,400 per gram, one can start accumulating for the long term."

India meets its demand through imports. The country imported around 15 tonnes platinum in 2011. This is expected to rise to 20-22 tonnes in 2012. The Mineral Exploration and Development Report for the 12th Five Year Plan Period has projected that platinum demand in India will reach 80 tonnes by 2017.