MUMBAI: Many home loan customers are hopeful of a substantial reduction in EMIs in 2014. Karthik Srinivasan, senior vice-president and co-head, financial sector ratings, Icra, believes interest rates will head downwards in the second half of 2014.

However, many experts disagree on its timing. "Taking into account global and local factors together, it is hard to say exactly when the rates in the system will come down. There is little room for policy rate cut in the quarter ending March 2014," says K Harihar, treasury head, FirstRand Bank.

"Even if inflation goes down from current levels, the jury is still out on whether it will result in a rate cut, though lending rates may see some marginal softening around this time if the liquidity situation eases in the real market."

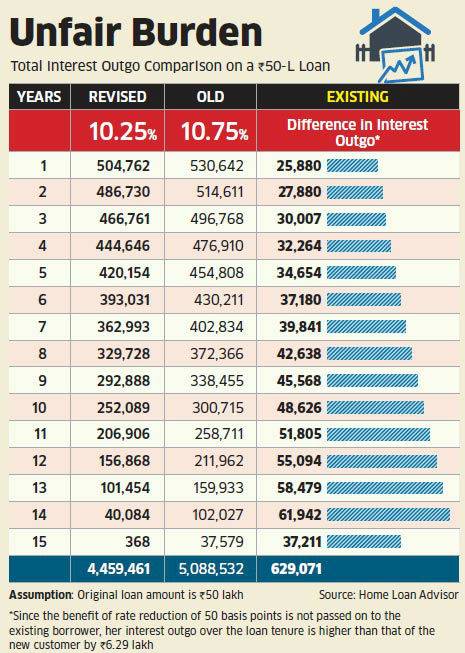

Hoping in Vain? Many loan advisors say that even if the rates go down as expected in the first half of next year, it need not translate into lower EMI for existing home loan customers. "If you look at the industry's reaction to the RBI's policy pause, you will find that no one has changed the base rate. Only the selling price - new rates meant for fresh loans- is reduced," says Vipul Patel, director, Home Loan Advisors, a mortgage consultancy firm. This means though some banks have cut their lending rates, the largest chunk of their home loan customers - the existing ones - have not benefited from it, he points out.

Many loan advisors say that even if the rates go down as expected in the first half of next year, it need not translate into lower EMI for existing home loan customers. "If you look at the industry's reaction to the RBI's policy pause, you will find that no one has changed the base rate. Only the selling price - new rates meant for fresh loans- is reduced," says Vipul Patel, director, Home Loan Advisors, a mortgage consultancy firm. This means though some banks have cut their lending rates, the largest chunk of their home loan customers - the existing ones - have not benefited from it, he points out.

In such a scenario, existing borrowers have only one unenviable option: try to convince their bank to lower rates." They should write to their lenders seeking a rate reduction. There is a lot of scope for negotiation in the current environment as many lenders are willing to entice borrowers of other banks with lower rates," says Patel.

"You should write to the lenders, explaining why you think a rate cut is in order. Ensure that all your correspondence is through emails. Do not rely on oral promises from your bank executives."

Expressing your intention to switch to another bank could also do the trick. If negotiations fail, you can go ahead and get your loan refinanced by another lender. You can also consider liquidating some of your investments to fund the prepayment of your loan. "As home loan interest rates go down, so will the deposit rates. Therefore, it makes sense to take stock of your FD returns and home loan interest at regular intervals.

If you are paying, say, 11% on your home loan and earning 9% on your fixed deposit, you can look at making a part-prepayment by breaking your FD," says VN Kulkarni, chief credit counsellor with the Bank of India-backed Abhay Credit Counselling Centre.

If you are a prospective home buyer waiting for the rates to come down before taking a loan, financial advisors ask you to be extremely cautious. Most of them say if you are looking for a place to stay, you shouldn't be bothered about the real estate price and interest rate movement. Of course, this is provided you can afford to buy the house.

"Home seekers should not postpone their decision in the hope that real estate prices will see a fall. As far as home loan interest rates are concerned, a quarter or half percent reduction will not make an earth-shattering difference. Do not defer a Rs 50-lakh decision for a Rs 500 reduction in EMIs," says Patel Home Loan Advisors.